The Solon City Council and city staff recently wrapped up several work sessions on the FY25 city budget. Cities in Iowa run on a fiscal year with the FY25 budget beginning on July 1, 2024, and ending on June 30, 2025. Work on the FY25 budget began in October of 2023 with Department Directors evaluating their department needs, researching expected costs of goods and services essential to their department operations, and reviewing past and current budget line items for their department to assist in forecasting expenses. This pre-budget work at the department level takes a few months so by December 2023 the goal is to have a good first draft version of the FY25 budget expenditures. Next, it’s necessary to determine expected revenues for the FY25 budget.

All cities in Iowa rely on property tax revenues from the properties within their cities to help fund the essential functions of city operations. The amount of property tax revenue each city receives is varied because each city has its own unique combination of properties that may include agricultural, residential, commercial, industrial, and railroad. Properties in Iowa are given a property assessment which is the dollar value of the property as determined by the city/county assessor for sake of property taxes. For example, a single-family residential house on a quarter acre of land within the city limits of Solon may have been assessed by the county assessor at the amount of $300,000. This is considered the assessed value or the 100% value of the property. Iowa has a Rollback limitation for each property category so no property owner pays taxes on their 100% or assessed value, rather they will only pay taxes on the taxable value of the property. The taxable value is determined by applying the Rollback percentage to the 100% (assessed) value of the property.

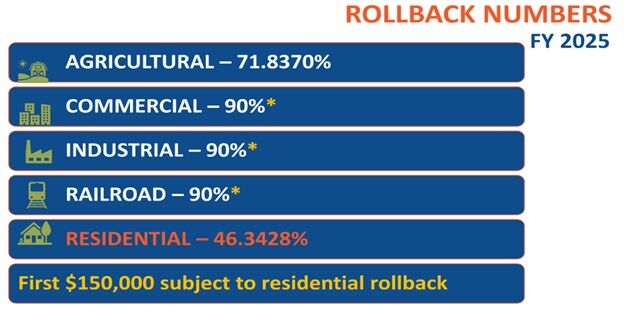

For FY25 budget year the Rollback for each property category will be as shown below: (see image)

Source: Iowa League of Cities

Using the example from above of a single-family residential house that has been given an 100% (assessed) value of $300,000, the taxable value of that property can be determined by multiplying the Rollback percentage for residential property of 46.3428% to the $300,000. That calculation is shown below:

Single-family residential house $300,000 x .463428 = $139,028.40

The taxable value of the property for the residential property in the above example is $139,028.40.

Homestead, Military, and Age 65 and older tax credits can further reduce the taxable value of residential property.

A commercial business that has a 100% (assessed) value of $300,000, will have a Rollback that is different from the residential example above because the Rollback for the first $150,000 of the 100% (assessed) value of a commercial business will be multiplied by the residential Rollback of 46.3428% then the remaining $150,000 will be multiplied by the commercial Rollback of 90%. That calculation is shown below:

Commercial business $300, 000

Step 1: $150,000 x .463468 = $69,520.20

Step 2: $150,000 x .90 = $135,000.00

Step 3: $69,520.20 + $135,000.00 = $204,520.20

The taxable value of the property for the commercial property in the above example is $204,520.20.

The Rollback for residential property changes each year. It is determined by the Iowa Department of Revenue and is based upon state property tax laws. Below is the five-year Rollback history in Iowa: (see image)

In Iowa, the annual Rollback percentage is the key for determining a property’s annual taxable property value. Once the taxable property value is known by the county auditor, this information is provided to Iowa cities by January 1st each year. For FY25 budget year the City of Solon has a total taxable valuation of property in the amount of $172,716,808. This is the dollar amount the county has determined is the taxable amount of property within the city limits of Solon.

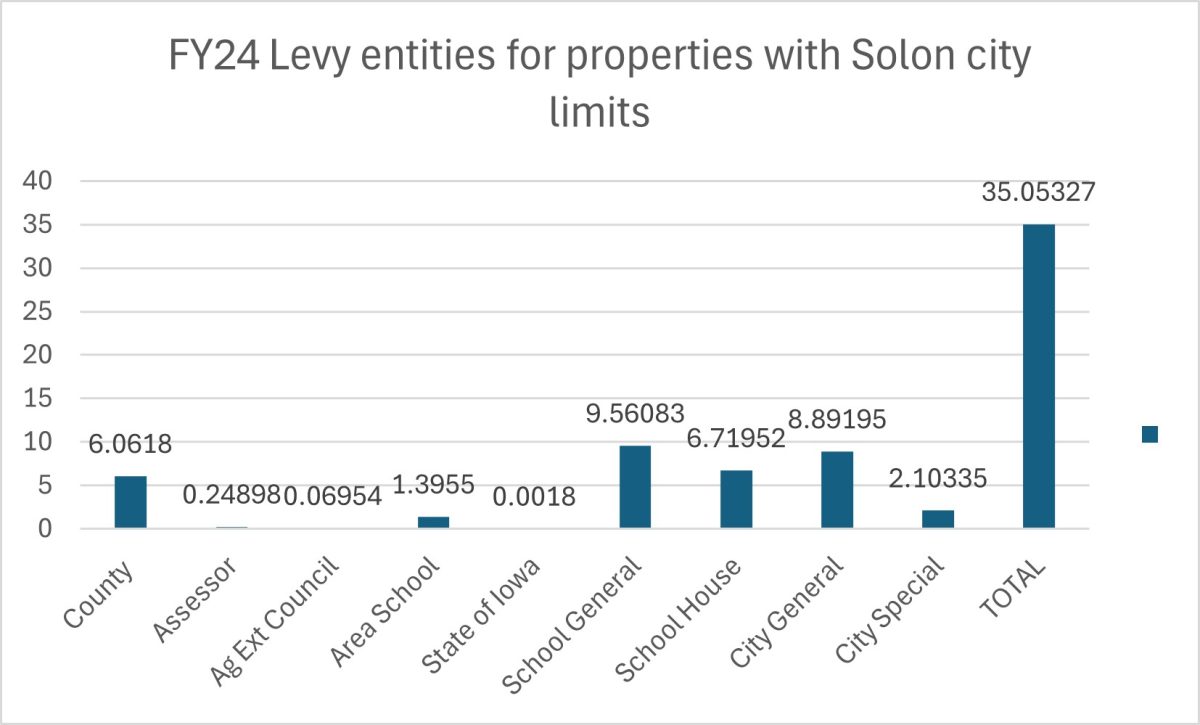

The total taxable valuation is a unique number for each city in Iowa and is the foundation for cities to determine what their levy (tax) ask will be for the FY25 budget year. Property taxes are comprised of several public agencies levy asking. When a resident pays their property taxes twice a year in March and September, the dollars are then distributed among these public entities based upon what they requested on their annual budget. For the current FY24 budget year, the residents within the city limits of Solon property taxes are collected and distributed as follows:

County 6.0618

Assessor 0.24898

Ag Ext Council 0.06954

Area School 1.3955

State of Iowa 0.0018

School General 9.56083

School House 6.71952

City General 8.89195

City Special 2.10335

TOTAL Levy FY24 (city limits) $35.05327

Source: Johnson County Iowa https://www.johnsoncountyiowa.gov/

Page: https://www.johnsoncountyiowa.gov/sites/default/files/inline-files/FY24%20Apportionment.pdf

A view of the above levy information in chart view is below:

The total $35.05327 levy for property owners in the city limits is applied to each $1000 increment of the taxable value total of $139,028.40 (above single-family residential example).

139028.40/1000 = 139.0284 x 35.05327 = $4,873.40

In the above example of the single-family residential property, $4,873.40 is the total property tax due and will be disbursed to each of the public entities accordingly by the county.

The information in Part 1 of this Budget Series focuses a lot on the Iowa property tax system and intended to help property owners in Solon understand how their property taxes are determined and how those dollars are distributed among several public agencies.

Part 2 of this Budget Series next week will review how the City of Solon prepares the FY25 budget based upon the taxable valuation information provided by the county, how city levy rates are determined, and understanding the Property Tax Notice residents received in the mail recently. This series will also look at how Solon levy rates rank among the other cities in Johnson County.

City of Solon Budget Series (Part 1 of 3)

Cami Rasmussen, Solon City Administrator

March 27, 2024

Entities