I voted for the H.R. 7024, the “Tax Relief for American Families and Workers Act.” This consequential legislation supports families and communities, invests in small businesses, and builds on the successes of the 2017 GOP Tax Reform.

The bipartisan legislation came about after negotiations between the Ways and Means Committee Chairman Jason Smith (MO-8) and the Senate Finance Committee Chairman Ron Wyden (D-OR). The negotiations and bipartisan work resulted in a larger legislative package that pairs tax breaks for both families and small businesses.

This legislation includes provisions that would expand the Child Tax Credit and boost the maximum credit per child from $1,600 to $2,000 through 2025. According to the Center on Budget and Policy Priorities, approximately “half a million or more children would be lifted above the poverty line” if this legislation is enacted.

The refundable Child Tax Credit also addresses the skyrocketing prices of everyday goods by adjusting the credit allowance for inflation in 2024 and 2025. Rather than limiting families and capping the credit at 15 percent of earned income over $2,500, the maximum credit for each taxpayer is calculated on a per-child basis, which would go a long way for larger families working to make ends meet.

The tax package also offers protections for affordable housing, by raising the ceiling for the low-income housing tax credit by 12.5 percent through 2025. This adjustment would also allow states to allocate more credits for affordable housing projects and reduce the tax-exempt bond financing requirement.

In addition to supporting families and protecting low-income housing credits, the legislation also invests in American businesses by extending three business deductions that were a part of the 2017 Tax Cuts and Jobs Act. It also supports companies and immediately deducts the cost of their U.S. based research and development (R&D) investments, rather than spreading the deduction over five years. The legislation also reestablishes the full and immediate expenditure on investments in machines, equipment, and vehicles.

Bottom line, this legislation is a major win for Iowa businesses and families. It not only helps families put food on the table, but it also invests and incentivizes businesses to increase R&D efforts, which leads to greater innovation.

During a time that is often marred by Congressional gridlock, I am extremely proud of this strong example of House Republicans leading a bill, taking it through regular order, and delivering for the American people. This pro-family, pro-worker, and pro-business legislation is good for our country and communities and now it is time for the Senate to act and pass this legislation.

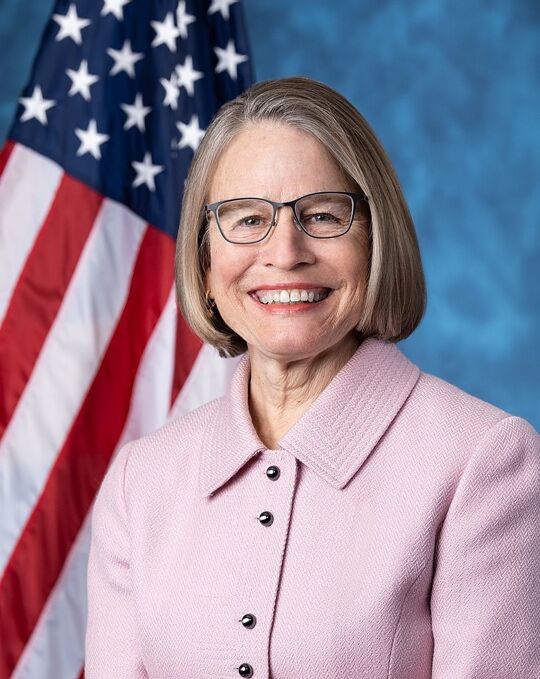

Mariannette Miller-Meeks currently represents Iowa’s First District in the United States House of Representatives.

The Tax Relief Package is a major win for Iowa businesses and families

Mariannette Miller-Meeks

February 22, 2024